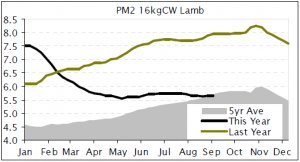

With expensive stock on hand, many thought they could ride out the fall in prices but there is now an increasing urgency to turnover of as much surplus product before the new season commences.

...but exports have lifted

Meat processors are making a dent in stocks and this is reflective in the latest NZ lamb export stats. In August, lamb exports were 16% higher year on year, driven by a 19% lift in frozen exports. Frozen lamb exports through the winter were higher with an extra 6300t shipped (+13%). Although increased volumes are putting pressure on the overseas market, they need to be cleared in order for the market to move forward. The underlying fundamentals for lamb are there; there is a global shortage of lamb. A lift in demand is also essential and this could happen if global economies recover somewhat and other proteins become more expensive e.g. grain-fed meats, in particular beef, poultry and pork.

UK lamb consumption lifts

Lamb consumption in the UK is improving which is important seeing the UK is NZ's number one lamb market. NZ lamb exports to the UK last month lifted 22% on August last year, driven by a lift in both chilled and frozen exports. The main reason behind a lift in consumption is the increased volumes hitting the market, with lamb usually being on promotion in some shape or form. Discounted lamb is proving the only tool for increasing sales, especially in these tough economic conditions when consumers are very budget conscience. Regardless, it shows that UK consumers are still willing to purchase lamb which is a positive. In the latest statistics from the Kantar Worldpanel, fresh and frozen lamb household expenditure increased by 8% the four weeks ended August 5th. This was largely driven by the 13% increase in volumes. With global supplies still comparatively tight, especially in the long term, the outlook for lamb is fairly positive.

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283. |